Target Reliability Tool Example

Target Reliability-Determine Target Reliability Based on Costs

This example illustrates how to use the Target Reliability tool in Weibull++ to estimate the target reliability for a product based on financial considerations.

With high product reliability, the initial production cost is expected to be high, and the cost due to failure is expected to be low. Moreover, a product with high reliability is expected to have a higher market share and higher unit sales price. A suitable reliability goal will be determined using these factors.

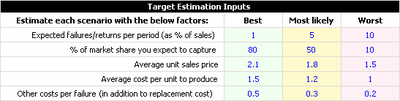

In this example, information on market share, sales prices, cost of production and costs due to failure are given in the following Figure.

The first row in the above table is the probability of failure during the warranty period. For example, in the best case, the expected probability of failure will be 1% (i.e., the reliability will be 99%). Under this reliability, the expected market share is 80%, average unit sale price is $2.1, average cost per unit to produce is $1.5 and other costs per failure is $0.50.

The assumed Maximum Market Potential is 1,000,000.

Solution

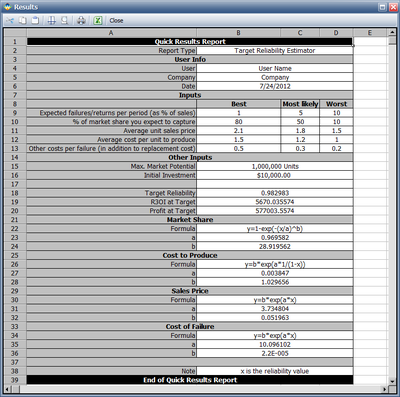

Based on the inputs, the cost models are estimated and the results are shown in below:

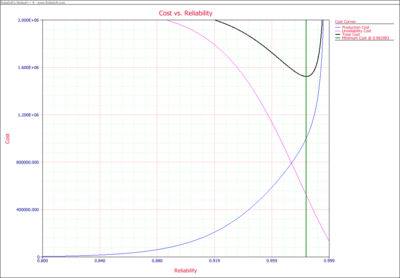

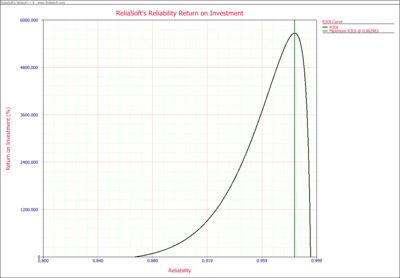

From these model, the cost Vs. Reliability plot is:

The plot shows the best reliability value is 98.298%.

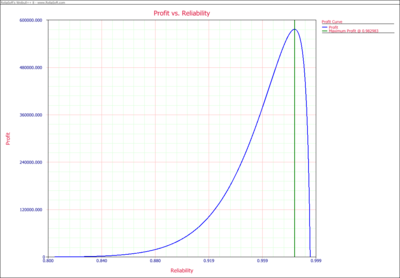

The Profit vs. Reliability and R3OI vs. Reliability plots are also given in below.

In the above R3OI plot, the initial investment is set to $10,000.