Target Reliability Tool Example: Difference between revisions

(Created page with ''''Target Reliability-Determine Target Reliability Based on Costs''' This example illustrates how to use the Target Reliability tool in Weibull++ to estimate the target reliabil…') |

Lisa Hacker (talk | contribs) No edit summary |

||

| (14 intermediate revisions by 6 users not shown) | |||

| Line 1: | Line 1: | ||

'' | <noinclude>{{Banner Weibull Examples}} | ||

''This example appears in the [https://help.reliasoft.com/reference/life_data_analysis Life data analysis reference]''. | |||

This example illustrates how to use the Target Reliability tool in Weibull++ to estimate the target reliability for a product based on financial considerations. | Deciding on a reliability goal/target involves trade-offs. This is because higher reliability typically correlates with higher production costs, lower warranty costs, higher market share and higher unit sales price. This example illustrates how to use the Target Reliability tool in Weibull++ to estimate the target reliability for a product based on financial considerations. | ||

</noinclude> | |||

'''Determining Reliability Based on Costs''' | |||

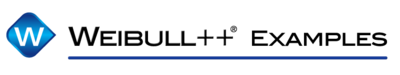

The following table provides information for a particular product regarding market share, sales prices, cost of production and costs due to failure. | |||

[[Image: Target Reliability Example Inputs.png | [[Image: Target Reliability Example Inputs.png|center|650px]] | ||

The first row in the | The first row in the table indicates the probability of failure during the warranty period. For example, in the best case scenario, the expected probability of failure will be 1% (i.e., the reliability will be 99%). Under this reliability, the expected market share is 80%, average unit sale price is $2.10, average cost per unit to produce is $1.50 and other costs per failure is $0.50. | ||

The assumed | The assumed maximum market potential is 1,000,000 units and the initial investment is $10,000. | ||

'''Solution''' | |||

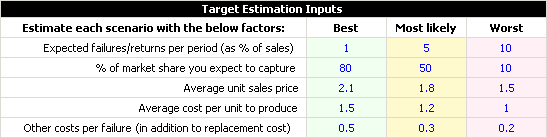

Enter the given information in the Target Reliability tool in Weibull++ and click the '''Plot''' icon on the control panel. Next, click the '''Analysis Details''' button on the control panel to generate a report of the analysis. The following report shows the cost models. | |||

[[Image: Target Reliability Example Model Results.png|center|550px]] | |||

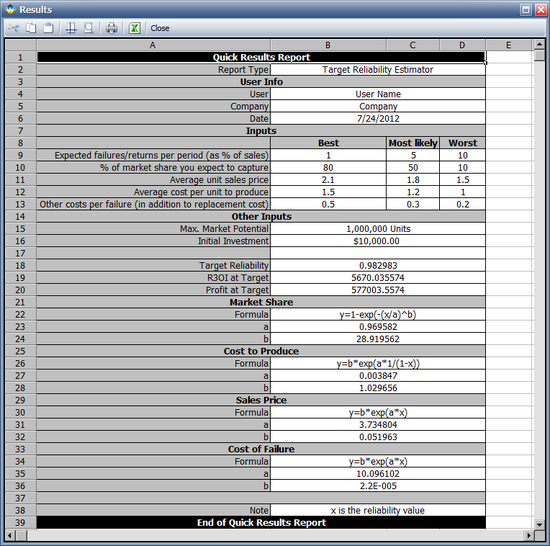

The following figure shows the Cost vs. Reliability plot of the cost models. The green vertical line on the plot represents the estimated reliability value that will minimize costs. In this example, this reliability value is estimated to be 96.7% at the end of the warranty period. | |||

[[Image: Target Reliability Example Cost Plot.png|center|650px]] | |||

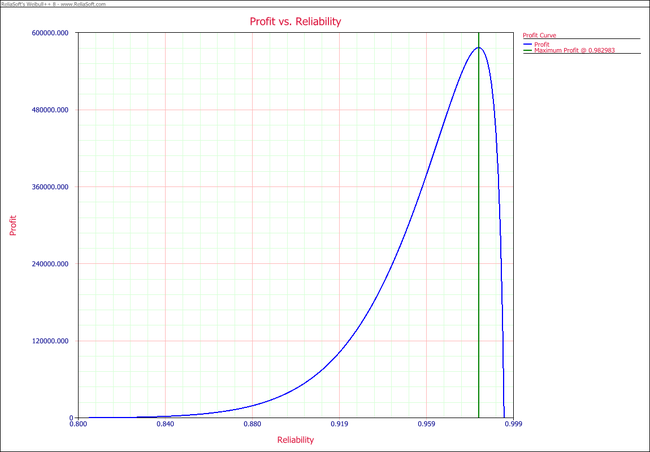

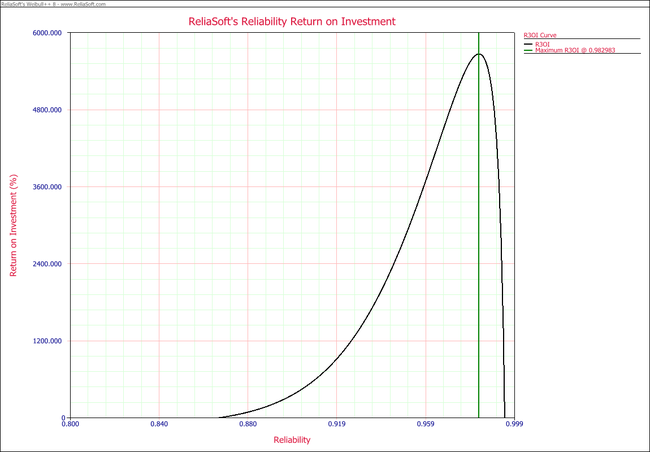

The following figures show the Profit vs. Reliability plot and the R3OI vs. Reliability plot. In the R3OI plot, the initial investment is set to $10,000. | |||

[[Image: Target Reliability Example Profit Plot.png|center|650px]] | |||

[[Image: Target Reliability Example | [[Image: Target Reliability Example R3OI Plot.png|center|650px]] | ||

Latest revision as of 18:57, 18 September 2023

New format available! This reference is now available in a new format that offers faster page load, improved display for calculations and images and more targeted search.

As of January 2024, this Reliawiki page will not continue to be updated. Please update all links and bookmarks to the latest references at Weibull examples and Weibull reference examples.

This example appears in the Life data analysis reference.

Deciding on a reliability goal/target involves trade-offs. This is because higher reliability typically correlates with higher production costs, lower warranty costs, higher market share and higher unit sales price. This example illustrates how to use the Target Reliability tool in Weibull++ to estimate the target reliability for a product based on financial considerations.

Determining Reliability Based on Costs

The following table provides information for a particular product regarding market share, sales prices, cost of production and costs due to failure.

The first row in the table indicates the probability of failure during the warranty period. For example, in the best case scenario, the expected probability of failure will be 1% (i.e., the reliability will be 99%). Under this reliability, the expected market share is 80%, average unit sale price is $2.10, average cost per unit to produce is $1.50 and other costs per failure is $0.50.

The assumed maximum market potential is 1,000,000 units and the initial investment is $10,000.

Solution

Enter the given information in the Target Reliability tool in Weibull++ and click the Plot icon on the control panel. Next, click the Analysis Details button on the control panel to generate a report of the analysis. The following report shows the cost models.

The following figure shows the Cost vs. Reliability plot of the cost models. The green vertical line on the plot represents the estimated reliability value that will minimize costs. In this example, this reliability value is estimated to be 96.7% at the end of the warranty period.

The following figures show the Profit vs. Reliability plot and the R3OI vs. Reliability plot. In the R3OI plot, the initial investment is set to $10,000.